About The Firm

Structuring Wealth for Maximum Security & Growth

Global Gain Holding was founded on the guiding principle of assisting clients in reaching their financial goals. We believe that wealth management is about understanding the personal, legacy, and professional goals of each unique client.

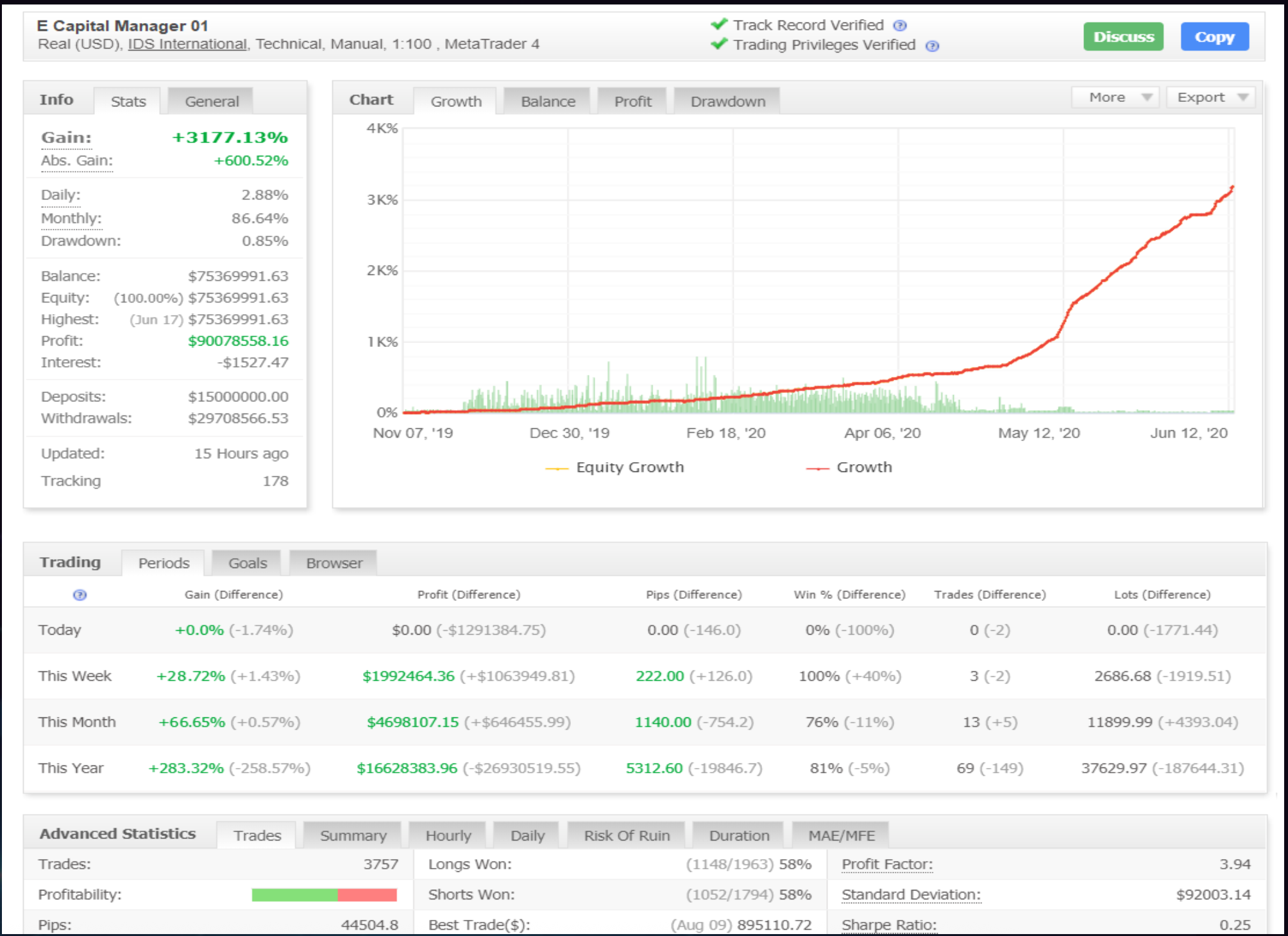

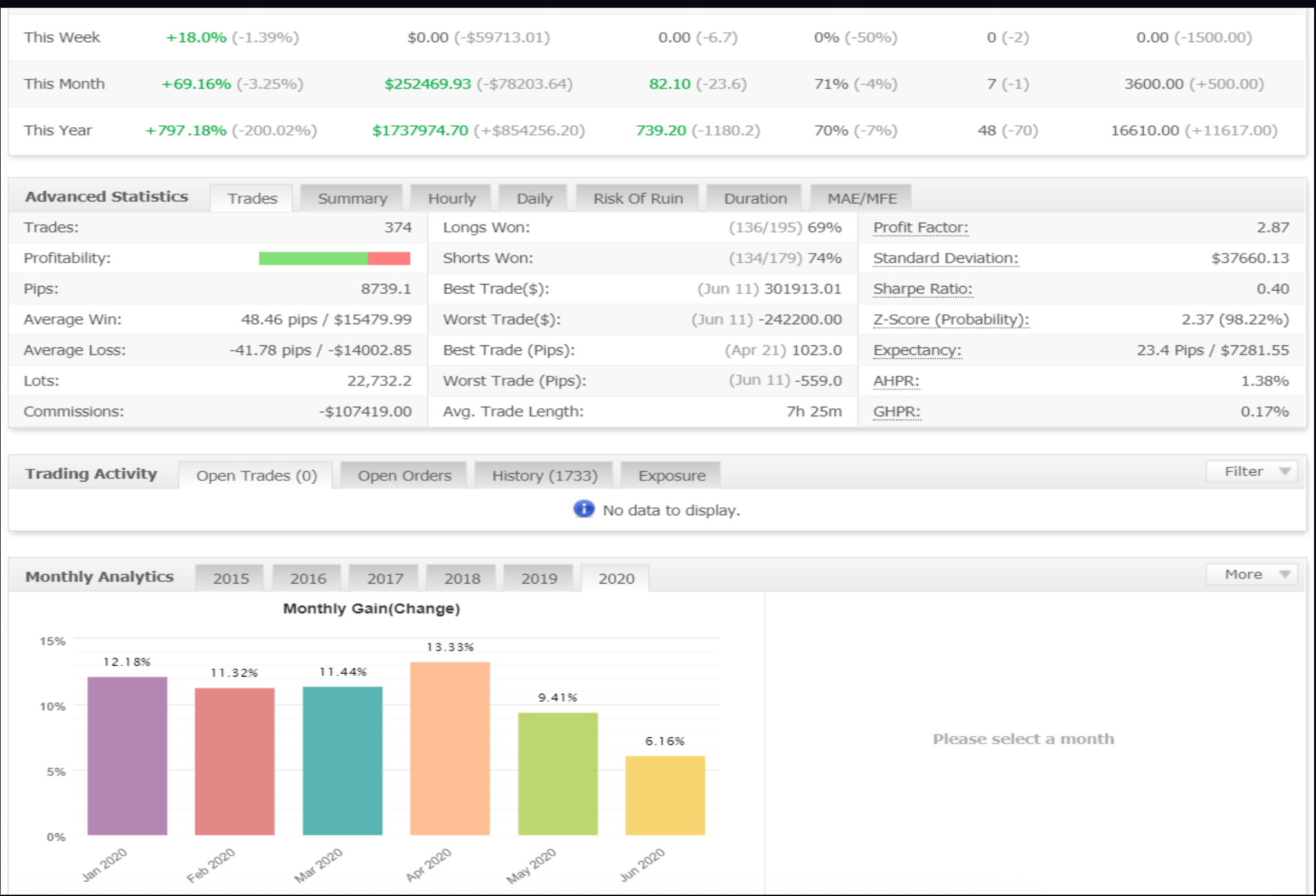

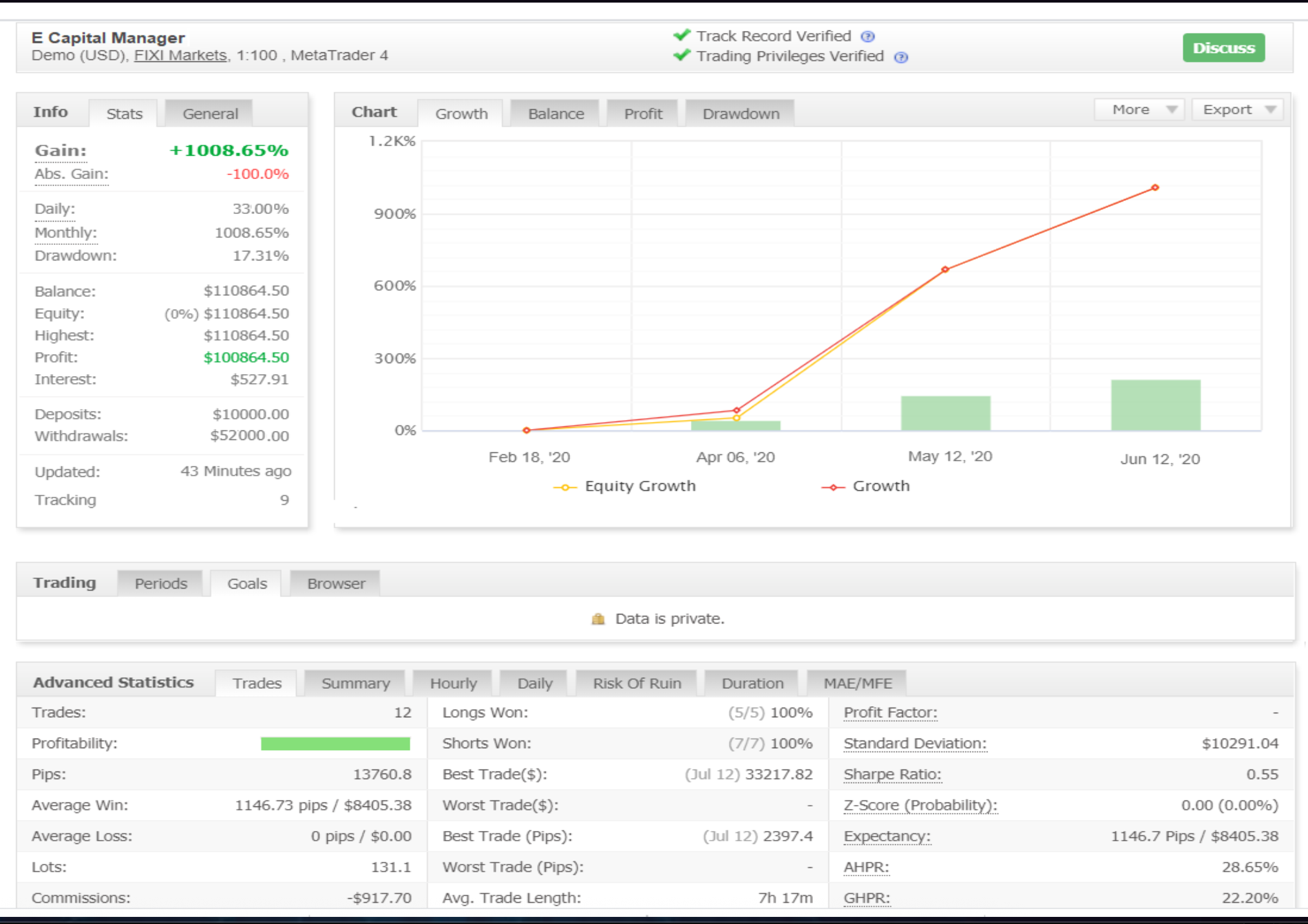

The firm utilizes an active, discretionary process to express global thematic ideas that consistently produce strong risk-adjusted returns not correlated to either traditional or alternative asset classes.

"Our independence allows us the flexibility to offer our clients individual portfolio management tailored to their specific needs and risk tolerance."

SEC Regulated

Licensed CRD# 117024

Risk Controlled

Monthly losses capped at 3%

Global Reach

G10 FX & Emerging Markets

Daily Liquidity

Most liquid global markets